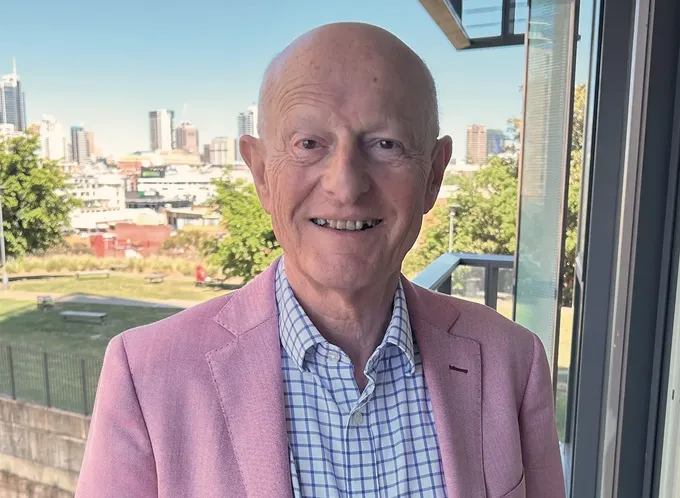

Like many of us, MAS Member Nigel Latta never gave his insurance much thought. That was until a devastating diagnosis changed his perspective on the importance of a financial safety net. Here, he talks candidly about cancer, life lessons and why we should all toughen up a bit.

With his gentle but straight-talking style, clinical psychologist Nigel Latta has made a career out of tackling the struggles that make us human. Since first appearing on our TV screens in the late 2000s, his knack for serving up home truths with hard science has made him into a Kiwi household name. Now, facing the fight of his life against incurable stomach cancer, he says getting real about the serious stuff is more important than ever.

“If you’re wading through a big sea of s***, you can’t exactly sit down, you just have to keep going. That’s often what it comes down to. I do all of the other stuff I’ve talked about for years, like shifting my focus to what I can control, but sometimes, it’s about telling myself to stop whining and get up! A bit of moping is alright but then it just gets super boring for everyone.”

For Nigel, 57, sharing his journey with the public has been part of the process. In an Instagram video that was widely picked up by media, he talks about the paralysing shock of the day of diagnosis, feeling like he’d “fallen off the side of the world”, eating ice cream and crying in a hotel room with wife Natalie when going home to face the kids was all too much, pressing a doctor for a timeframe and being told he may have just 6 to 12 months to live.

It’s the sort of chat that nowadays might come with a content warning, but Nigel’s got thoughts on that too.

“Stuff happens in life, and I don’t know why we need to be warned of that. I didn’t put a trigger warning on that video because sometimes I do think we need to toughen up a little bit."

"People have said I’m courageous for telling my story. I don’t think so. It’s just words coming out of my face. It’s cancer, it’s cells dividing, it’s just a thing.”

On a recent video call with onMAS, he’s noticeably pale but still quick to crack a smile. He says there are good days and bad days, frustrations and wins, and an endless rotation of doctors’ appointments.

At one point, there’s a flurry of fur in the background as a small dog jumps at the back of his chair. “He’s about the size of a rat and he’s no good at anything, but he’s got a good heart,” Nigel says dryly, barely skipping a beat as he rattles off the chemotherapy schedule and his latest daily routine.

“There’s an enormous amount of television, sometimes I get so bored with TV it’s almost painful,” he eyerolls. “All I’m doing right now is feeling sick and just tired enough that almost anything seems like a bother. I haven’t lost my hair, but it’s weirdly stopped growing and I haven’t needed a haircut in 4 months, so that’s a bonus!”

The first phone call

Hearing the word ‘cancer’ at the doctor’s office is earth shattering for anyone, and for Nigel, the fact that it came 6 months to the day since getting married to Natalie, also a clinical psychologist, added extra sting.

While nobody knows how they might react until they’ve been there themselves, it was thoughts of family and finances that jolted him into action mode.

“Literally, the first call I made after hearing that terrible early prognosis was to MAS. I called Andy [Andy Schlaffer, Senior MAS Adviser], because I just suddenly thought how the hell am I going to pay the bills? How are the people around me going to cope? Have I taken care of everyone?’ I couldn’t remember what I’d done with insurance, but I knew I had it. I don’t actually recall much of that phone conversation."

"But Andy had done a great job with structuring my life insurance policy, and it made an enormous difference to us. It was all such a relief when you’re dealing with everything else."

“Otherwise, we would have been selling the house and downsizing while I was having chemo, it would have been grim. I think insurance feels like a luxury, but if you can afford it, it’s not a luxury. When you need it, it’s a godsend.”

A MAS Member for more than 20 years, Nigel says the payment from his MAS Life Insurance policy has also allowed for access to the non-funded immunotherapy treatment Keytruda. Alongside recently funded Herzuma and a regimen of high-dose chemotherapy, the results are promising.

“I had cancer cells between my lungs, all around the stomach, in the peritoneum [abdominal wall lining], and that’s all gone now. I’ve got another nodule in the peritoneum that’s reduced by about 45%, and activity in the main tumour itself is down by 60%. So these drugs help. But sadly, particularly with oncology, the difference between living and dying is often money.”

Nigel, who holds Life Insurance and Income Protection policies with MAS, says his experience has made him an advocate for the importance of financial protection should life throw a curveball.

“Whenever I talk to anyone now, and it’s my go-to with all of our friends and family members, I say you’ve got to have life insurance, you’ve got to have health insurance and you’ve got to have income protection insurance.

“And every single time we’ve had anything to do with MAS, you don’t feel like you’re talking to an insurance company that’s just trying to minimise their losses. You know you’re talking to good people like Shaun [Shaun Bates, Senior Disability Claims Adviser] who really care and who want to help you.”

Walking the talk

In the midst of a career spent studying human behaviour and how the mind works, he says few things have put his theories to the test like living with cancer. And for the Oamaru-born ‘shrink’, as he calls himself, the journey so far has highlighted the importance of looking out for others.

“One of the things I’ve often talked about is how you get to choose your response,” he says. “I decided early on that the most important thing was to make it as easy as possible on the people around me. I kind of feel like having cancer is the easy part in all of this. It either gets better or it gets worse and I die, and at that point, it’s not going to be that big a deal for me. I’m not afraid of dying. But it’s the people that have to watch that process. I’m trying to make sure that people around me aren’t dragged down by this. And that ties into focusing on the things I can control, like how much sleep I’m getting and how much I’m eating.”

From his new perspective as the ‘sick person’, he’s also learned that actions speak louder than words when it comes to offering support in a time of need.

“There are 2 sorts of offers that you get from people. Some say let me know if there’s anything I can do to help. Other people say I’m bringing around some macaroni cheese. What I’ve squirrelled away for when friends run into difficulties is to do the second option. Sometimes when you’re going through things, you don’t know what you need or what would be helpful.”

These days, with work currently on hold and a new path to navigate, Nigel says tests, scans and treatment plans will be his focus for the future. With steadfast support from Natalie, family and friends, he’s taking each day as it comes and leaning in to life’s positives.

“Natalie and I have talked a lot about this whole thing, and neither of us feel angry,” he says. “I know it works for some people to give the tumour a nickname and yell at it, but for us, they’re just cells, they don’t know what they’re doing. I’ve got a bit of a dark sense of humour at the best of times, and for me, that feels better than getting all earnest about it.

“And I’ve been preaching about resilience for so long, it’s time for me to walk all that talk! It’s easy for anyone to be great when they’re feeling good, but it’s when it’s really s***, that’s when you find out who you are. I’m not perfect, and there are times when I’ll get grumpy and days where I get gloomy. But you just have to get back up. Fall over, get up. That’s how it works.”

Are you financially prepared for the unexpected?

We know that life has a habit of throwing curveballs. But putting some safeguards in place to prepare for the unexpected gives you extra peace of mind, both now and into the future.

At MAS, we offer a range of ways to help protect you and your family financially, including life, income and disability cover. To talk through your life insurance and income protection needs, please call the team on 0800 800 627 or email us at info@mas.co.nz. For more information, see mas.co.nz

This article provides general information only and is not intended to constitute financial advice. Before taking out any insurance product, you should carefully consider the terms and specific policy wording. Underwriting criteria will apply.

MAS is a licensed financial advice provider. Our financial advice disclosure statement is available by visiting mas.co.nz.

Know someone who might enjoy this?

Read this next

-

August 2023

What everyone gets wrong about emergency funds

-

November 2023

The emotional equation of retirement planning

Greater good

See all-

March 2021

Candles for a cause

-

March 2021

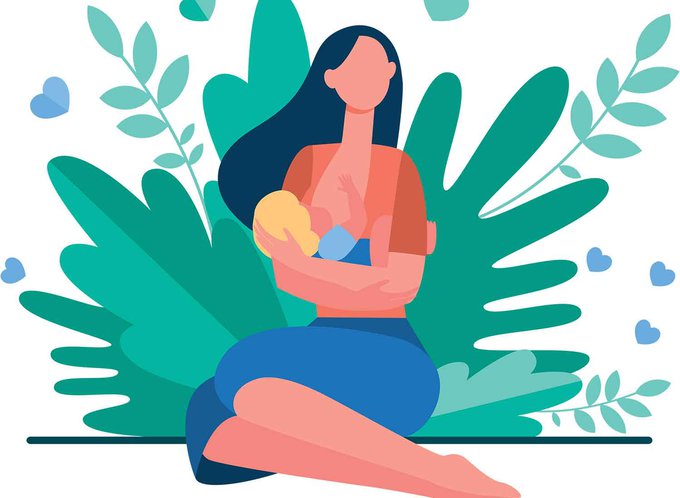

Helping Kiwi babies thrive

-

March 2021

Creating a Deaf-inclusive Aotearoa