Āki is MAS’s health and wellbeing portal, which is free to join for all Members and their families. This story, originally published on Āki, has been republished in OnMAS with permission from Synergy Health.

In the good times, it can be easy to be a bit loose with money. But as darker economic clouds appear on the horizon, it is now perhaps a good time to be more mindful and intentional with our money and finances. Good money habits don’t just happen, however. Like so many other aspects of our wellbeing, strong financial health is a skill built from awareness, reflection and a solid understanding of our values and intentions for whatever stage of life we are in.

An emergency fund is an essential component of good money habits and a sound financial plan. It is a sum of money set aside for unexpected expenses such as job loss, medical bills or car repairs. It is typically recommended that your emergency fund should be the equivalent of at least three months of typical expenses. Having an emergency fund in place can provide peace of mind and help you avoid taking on debt during difficult times. Unfortunately, many people do not have an adequate emergency fund or do not have one at all.

Why is an emergency fund important?

An emergency fund is an important safety net that can help you avoid financial distress in the event of an unexpected expense. Without an emergency fund, you may have to rely on credit cards, loans or other forms of debt to pay for unexpected expenses. This can quickly lead to a cycle of debt and interest, which can be difficult to escape from. An emergency fund, on the other hand, can provide you with the financial security you need to cover unexpected expenses without adding to your debt.

Another reason why an emergency fund is important is that it can help you manage financial stress. Unexpected expenses can be stressful, especially if you are not prepared for them. Having an emergency fund in place can help you feel more secure and in control, even in the face of unexpected expenses. This can help reduce your stress and allow you to focus on other important aspects of your life.

Āki Wellbeing Hub

All MAS Members and their families can sign up to Āki, an online resource centre that provides tools and simple, pragmatic advice about how to improve your physical health along with your mental and financial wellbeing. There are also loads of great discounts and regular prizes including Prezzy cards and Fitbits.

To join Āki, visit mas.co.nz/aki-wellbeing and follow the steps to sign up.

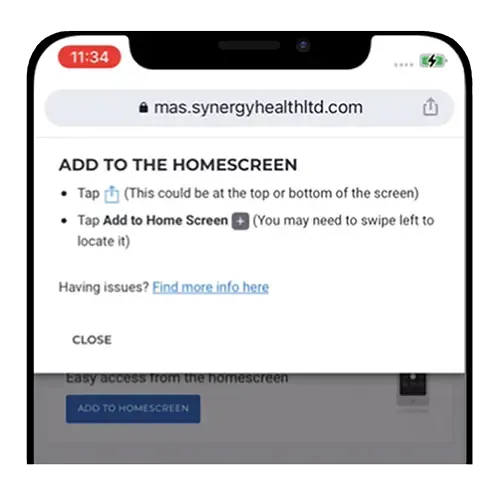

Access Āki Wellbeing Hub on the go

Āki now has improved mobile usability. To access content on the hub on mobile, visit the hub from your mobile phone and follow these instructions to add the app to your homescreen.

Common mistakes people make when considering an emergency fund

Despite the many benefits of having an emergency fund, many people make common mistakes when considering the establishment of an emergency fund. These are some of the most common mistakes.

Not having an adequate emergency fund

Many people believe that they only need a small emergency fund or that they can rely on credit cards or loans in the event of an emergency. However, this can be a dangerous assumption. You should aim to have enough money in your emergency fund to cover at least three to six months of expenses.

Not making it a priority

Establishing an emergency fund should be a priority in your financial plan. Unfortunately, many people do not make it a priority and instead focus on other financial goals such as paying off debt, saving for retirement or investing in the stock market. While these goals are important, it is essential to have an emergency fund in place before pursuing other financial goals.

Not considering all potential expenses

When establishing an emergency fund, it is important to consider all potential expenses, not just the most common ones. This may include expenses related to job loss, medical bills, car repairs or natural disasters. Make sure you have enough money in your emergency fund to cover all potential expenses.

Not regularly contributing to the fund

Once you have established an emergency fund, it is important to regularly contribute to it. This will help you build up your emergency fund over time and ensure that you have enough money when you need it.

And the biggest thing people get wrong about emergency funds?

Having the emergency fund tied up in investments, shares and property.

Investments such as shares and property can be subject to market fluctuations and may not be easily accessible when you need them. Additionally, if you need to sell off your investments to access the funds, you may have to do so at a loss.

It is all well and good looking at your investment portfolio on an upswing and feel that you are safe in the event of an emergency. But what if the emergency is in the middle of a down swing? If you need your emergency funds because your car has broken down AND the market is down 30%, not only are you out of pocket for the emergency vehicle repairs but you have locked in your investment losses.

This is why it is important to have your emergency fund in a cash form such as a savings account or money market account, which is easily accessible and not subject to market fluctuations.

Know someone who might enjoy this?

Read this next

-

March 2022

Taking an active approach to investing

-

July 2022

The Curve: Raising financial literacy

-

March 2023

Do our emotions harm or help our investing?

Money

See all-

March 2021

Reimagining the Kiwi homeownership dream

-

March 2022

Taking an active approach to investing

-

July 2022

The Curve: Raising financial literacy