MAS welcomed Helen McDowall as Head of Investments and Business Development in late July. She explains why she chose MAS after heading up NZX Smartshares business for four years.

Updated 11 January 2024

I joined MAS because business and investment has to change if we’re going to fix the big social and environmental issues the world is facing.

I chose MAS because I believe in our purpose – to inspire a healthier Aotearoa. I wanted to work for a company that was championing every New Zealander’s right to good healthcare opportunities, regardless of where or how they grew up.

I know that, if our generation is going to make positive change, business has to play a big part. I could see that the MAS investment team is genuinely walking the talk.

On top of that, MAS’s mutual ownership structure and charitable status means we aren’t influenced by short-term profit motives for external owners. Rather, we’re motivated to maximise the investment returns for our Members and to maximise the impact the MAS Foundation has on our society.

I think MAS has a business model tailor-made for a new era of constructive and positive capitalism. I can see the business world transforming for the better, and I want to be part of a New Zealand company at the forefront of that change.

But I’m a realist too. I know we’re not anywhere near there yet. Responsible investing isn’t a destination – it’s a process that we have to build into everything we do.

It isn’t just about exclusions. It’s also about looking at who you’re investing in, their governance, what kind of social impact they’re having and how they conduct themselves with respect to the environment and then taking action as a result of what you learn about these companies.

We’re continuing to evolve our approach all the time. As a general insurer, MAS can see the direct impact of climate change every day through claims. Right now, we’re working hard to build positive environmental impacts into our investment approach.

It’s a huge challenge, but it’s hard to think of one that’s more important to the world right now.

Know someone who might enjoy this?

Read this next

-

July 2021

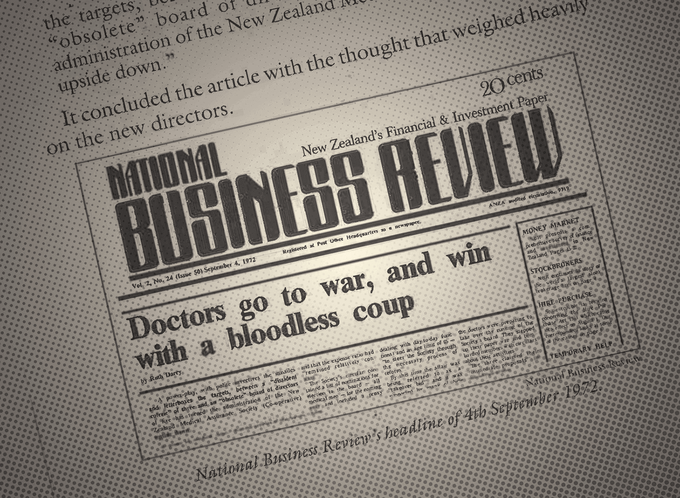

The moments Members shaped MAS

-

March 2022

Putting it plainly

-

November 2022

Ethical investing: green win or greenwash?

Money

See all-

March 2021

Reimagining the Kiwi homeownership dream

-

March 2022

Taking an active approach to investing

-

July 2022

Saving through the storm