By the time this issue of OnMAS reaches our Members I’ll have come to the end of my 20 years as CEO of one of the finest little insurance companies in the world.

I’ve been reflecting recently on how much MAS has evolved over two decades but also how the fundamental character of the company hasn’t altered. For me, there’s one essential reason for that. We’re a mutual.

I’ve been reflecting recently on how much MAS has evolved over two decades but also how the fundamental character of the company hasn’t altered. For me, there’s one essential reason for that. We’re a mutual.

Twenty years ago, MAS had around 20,000 Members, mostly medical professionals, and we mainly provided general insurance. Today, we’re a bigger, financially stronger organisation that offers insurance and wealth management services to around twice as many Members, over half from non-medical occupations. We’ve also changed our tax status, we’re now a registered charity and a proportion of our earnings goes to the MAS Foundation.

This remarkable evolution would not have been possible if MAS was not a mutual company. It’s the critical factor that distinguishes us from insurance companies owned by shareholders and the one thing they can’t replicate.

A mutual company doesn’t have to balance the competing interests of shareholders and customers, because they are the same people.

Martin Stokes

Over my 20 years at MAS, it was always the expectations and the attitudes of our Members that drove our most fundamental business decisions. We never had to balance the impact of a business decision on quarterly results or shareholder returns.

The only question we ever had to ask was what’s the best outcome for Members?

The mutual spirit motivates the extraordinary people who work at MAS. The fact our Members have voted us Consumer NZ People’s Choice champion for home, contents and car insurance for six years running is solely down to the people who work for MAS caring deeply about our Members.

That thinking drove some of the best business decisions we made in the past 20 years – none more than our switch to replacement value house insurance. Today, we’re one of the few insurers in New Zealand offering area replacement house insurance. But 15 years ago, the reverse was true – we offered only nominated sum insured house cover.

After looking at the situation, we realised that many of our Members were disastrously underinsured and would never be able to replace their house with like for like in the event of a disaster. So we switched to offering area replacement. The switch was expensive – it meant we had to buy an additional 50% reinsurance cover, and that caused us some short-term financial pain. But it was the right thing to do for our Members, and 18 months later when a series of earthquakes devastated Christchurch, we were glad we made the call to change.

The MAS Foundation

Top / The MAS Foundation

Bottom / The mutual spirit motivates the extraordinary people who work at MAS

The mutual spirit motivates the extraordinary people who work at MAS

MAS switched to offer area replacement cover 18 months before the Christchurch earthquakes

Top / MAS switched to offer area replacement cover 18 months before the Christchurch earthquakes

Bottom / Martin with his kids

Martin with his kids

That same collective spirit of mutuality is behind our evolution into a standard bearer for stakeholder capitalism. Over the past two decades, it’s striking how much society’s expectations of business have shifted. Climate change has taught us that business has a responsibility to the environment. Growing inequality has challenged businesses to promote social equity in the communities they serve. Because MAS is a mutual, when our Members made it clear to us that they supported our response to these trends, we were able to move quickly.

First, we entrenched the principles of responsible investing into our wealth management operations. Next, we started our transformation into a company that’s genuinely driven by a purpose: “to inspire a healthy Aotearoa”. Today, we’re capable of making a genuine difference to the wellbeing of communities throughout our country via the MAS Foundation. In 2018, our Members hardwired that new caring approach into the DNA of our company when they voted to make us a registered charity. A shareholder-owned company that exists to return dividends simply could not do this.

As I leave MAS, I’m looking forward to the next phase of my life. There will be new opportunities but my greatest motivation is being a dad who’s more present in the lives of my children. As I take stock at the end of my stewardship of MAS, I ask myself is MAS a company that’s building a better world for my kids? I’m certain that it is. And I know why.

What makes MAS such a remarkable company is our Members. As I sign off, I would like to thank you all for keeping the caring and collective spirit of MAS mutuality strong. Long may it thrive.

Know someone who might enjoy this?

Read this next

-

March 2021

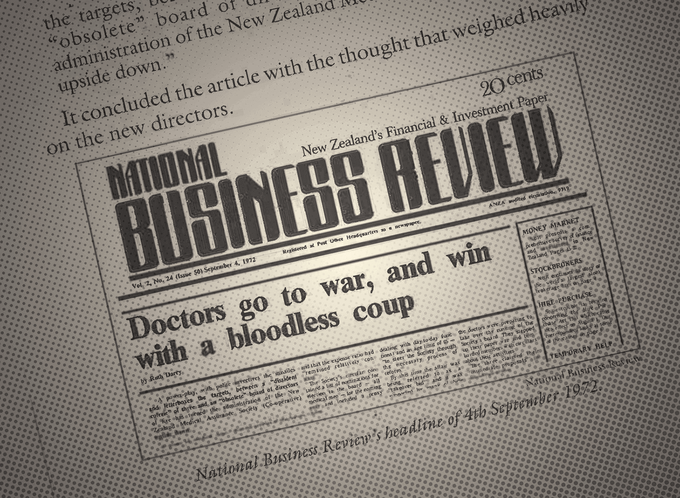

Made for today a century ago

-

July 2021

The moments Members shaped MAS

-

March 2022

5 ways MAS is becoming more sustainable

-

July 2022

Insuring for a healthier planet

Professional life

See all-

March 2021

Made for today a century ago

-

March 2021

The great brain gain

-

March 2021

A hectic, horrific working holiday

-

March 2021

Smooth sailing for Southern Spars