Are we being led by our emotions to make poor money decisions – and how can we make more rational choices when it comes to our finances?

Scan the property headlines of Stuff or the New Zealand Herald on any given day and the same adjectives stand out: worried, anxious, frustrated, fearful. We’re humans, after all. Whether it’s our mortgages, KiwiSaver schemes or other financial investments, we have an emotional attachment to them whether we like it or not. And according to behavioural economics, it is thought that the pain of losing is psychologically about twice as powerful as the pleasure of gaining.

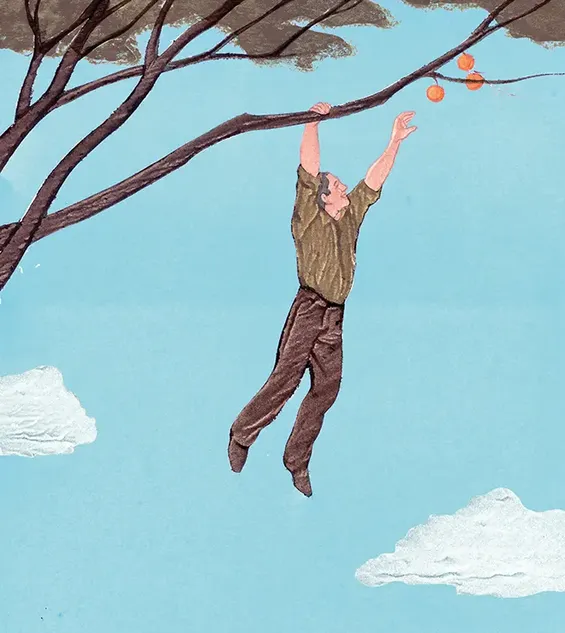

The emotions we all share, from fear to exhilaration, also feed into the investment decisions we make. Are we really led by our psychological instincts to make poor choices instead of absorbing all the relevant information and remaining reasonable and logical with our money?

Emotions play a significant role in our investing

MAS Head of Investments and Business Development Helen McDowall says that, although we may consider ourselves to be rational, we make all sorts of emotionally charged decisions when it comes to investing.

“When markets rise and everyone’s making money, our selective memories can kick in to convince ourselves that this time is different.

We become not only overconfident, but also fearful of missing out. It feels safer to follow the crowd, so we keep investing even though asset prices might be getting stretched,” she says.

According to global investment and risk advisory company BlackRock, investors who have followed their emotions, joining the crowd of other emotional investors, have historically regretted it. Its aggregate data from 1993 to 2021 shows that investors who went ‘against the herd’ and bought when others were selling made an average return of 15% on the S&P 500, while those who were led by their emotions made 5.5%.

MAS Head of Investments and Business Development Helen McDowall

So should we all just go ‘against the herd’ when investing?

There are a number of so-called ‘contrarian investors’ who believe it wiser to purposely go against market trends by selling when others are buying and buying when most investors are selling.

But going against the grain is simply another investment strategy that carries its own risks, just like any other. Even Warren Buffett, who has taken a contrarian approach throughout much of his investing career, cautions about the traps of falling into any particular strategy: “Being a contrarian isn’t the key, but being a crowd follower isn’t either.”

Moreover, we all lead individual lives with different short-term, medium-term and long-term financial goals that won’t necessarily line up with our ideal market conditions. So how should we reconcile the fact that we’re emotional beings at the same time that we want to be rational investors?

When in doubt, zoom out

Helen believes the answer is to try to separate your emotions from your investing by deliberately taking a multi-decade view and keeping this front of mind. Reminding yourself that market volatility is perfectly normal will help to calm your emotional response when reading news articles about bear markets or housing crashes.

“As humans, we tend to overweight the importance of information that’s recent and negative. It’s easy to forget that, over the past 30 years, world poverty has fallen and share markets have generally risen."

Helen McDowall

“Today’s headlines of rising interest rates, inflation and war in Europe can be just too salient.”

Helen points to the more than 60,000 New Zealanders who switched their KiwiSaver funds, mainly to lower risk, when the COVID-19 pandemic emerged and national lockdowns were announced. This led to lower returns. By the time the market recovered in August of that year, over 90% of those who had switched were still in lower-risk funds, effectively locking in their losses.

This view is echoed by financial planner Liz Koh, who recently told Radio New Zealand that, along with diversification, time in the market is a basic principle of not allowing your emotions to drive your investment behaviour and to help deal with your feelings toward risk and volatility.

Outsource your emotions

A second approach is to leave investment decisions in the hands of a professional rather than going it alone.

We already do this with our doctors, dentists and lawyers, yet a surprising number of New Zealanders don’t actively seek out advice to help with their finances.

A financial adviser can improve your economic outcomes by helping you to understand your goals and choose the right investments. Even more importantly, the value an adviser can bring is to help you to stick with your plan through good times and bad. Having an expert between you and your money helps ensure you don’t make irrational decisions that could set you back years. MAS Members have access to a network of commission-free MAS Advisers based all around New Zealand.

Emotions are not our enemies

It’s important to remember that emotions also play a hugely positive role in our lives, and while it’s easy to suggest we should simply avoid allowing them to influence our investment decisions, this isn’t always realistic. Psychologists also tell us that it’s healthy to believe that we have a degree of control over our emotions.

One final way to approach the issue is simply to understand and recognise the emotional biases that can kick in when we are exposed to risk or reward. The five most commonly referenced are loss aversion, overconfidence, self-control, status quo and regret aversion.

One study found that building emotional intelligence (EI) can play a beneficial role in this regard. The authors define EI as the ability “to recognise and use emotions productively”. When investing, this means recognising and interpreting the biases mentioned above and using that knowledge to help you make more reasonable and optimal financial decisions.

For example, when you see a story about specific shares dropping in value and opinion pieces predicting further falls, step back and ask yourself whether your instinct to take action is really just your brain kicking in with loss aversion bias.

So whether you choose to follow your instincts with investing, manage your emotions as best you can or outsource to a financial adviser, it’s best to think about your emotions as neither inherently harmful nor helpful. They make you who you are, and it’s your ability to control them that ultimately counts.

Medical Funds Management Limited is the issuer and manager of the MAS KiwiSaver Scheme and MAS Retirement Savings Scheme. The Product Disclosure Statements for each of the Schemes are available at mas.co.nz.

This article provides information of a general nature and is not a substitute for professional and individually tailored business, legal or financial or legal advice. © Medical Assurance Society New Zealand Limited 2023.

Know someone who might enjoy this?

Read this next

-

March 2022

Taking an active approach to investing

-

November 2022

Ethical investing: green win or greenwash?

Money

See all-

March 2021

Reimagining the Kiwi homeownership dream

-

March 2022

Taking an active approach to investing

-

July 2022

The Curve: Raising financial literacy