Is your business ready for sudden change?

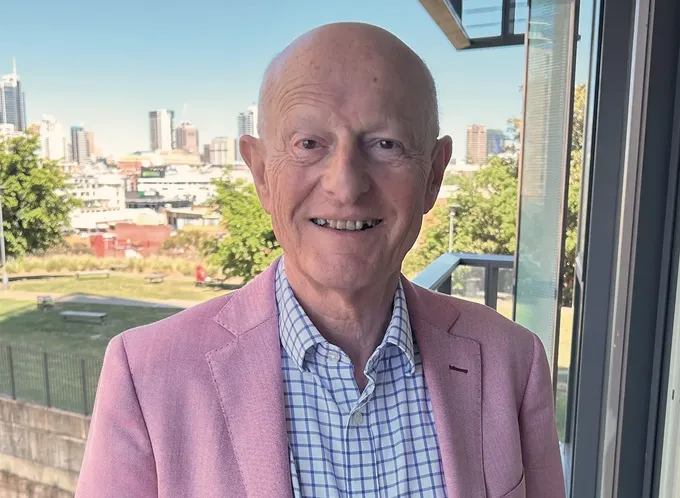

If you’re busy running a small business, keeping on top of the everyday tasks can be time-consuming. But with MAS Business Life Plan, you can have peace of mind knowing you’ve protected your business against the impact of losing a shareholder or key person, says Phil Belcher, MAS Head of Product (Life).

In the acclaimed HBO series Succession, the Roy family navigates intense power struggles and personal conflicts as they grapple with who will take over their sprawling media empire after their formidable leader steps down or passes away.

Small to medium-sized business owners in New Zealand might not have billion-dollar empires to manage, but they face similar challenges, What if a shareholder or key person in the business dies or suddenly can’t work any more? And what about handling debt in these situations?

Typically, businesses have insurance to cover them against material damage in case of events like fire or natural disasters as well as liability insurance to protect against legal claims. However, fewer of them insure the very people who drive the business or plan for what will happen if they die or suffer permanent disability.

Succession planning is essential, The 3 critical areas of protection for small to medium-sized businesses are:

• shareholder protection

• key person protection

• debt protection.

Why succession planning matters

Succession planning isn’t just about preparing for the worst. It’s about ensuring your business can continue to operate in the face of an unexpected challenge. By having a solid plan in place, small business owners can protect their business and their peace of mind. Here are some important questions to help start the process:

- What would happen if you or a fellow shareholder dies or becomes totally and permanently disabled? A solid plan ensures the business can buy shares back from the estate for an agreed amount at the agreed time. This ensures continuity of control and helps prevent potential conflict.

- What would the financial impact be on your business if you lose a key person? The sudden loss of a practice manager, nurse practitioner or technical specialist can lead to immediate financial pressure as well as impacting day-to-day operations.

- Have any shareholders borrowed funds with a personal guarantee? Banks will call in loans against personal guarantees in the event of death or permanent disablement, which could impact both your business finances and the personal finances of the deceased shareholder’s family.

MAS can help you understand the impacts of these scenarios as you begin to think about succession planning for your business.

Understanding the business impact

Most small businesses have someone who they consider irreplaceable. The sudden loss of this person can lead to an immediate reduction in revenue, an increase in expenses, and lower profits. Existing contracts and client responsibilities may be put at risk, and new work might be put on hold, leading to a significant loss of revenue.

Finding and training a suitable replacement also takes time and money. This process can also divert other employees from their regular work, resulting in decreased productivity and putting additional pressure on the business.

Liquidity and credit can also be affected if they are tied to the key person. Creditors may increase pressure for payments, and lenders could be reluctant to extend further credit to the business after losing such a pivotal person.

Additionally, without proper shareholder protection, new and possibly unqualified owners might inherit shares, potentially disrupting business operations and causing conflict among remaining partners. This can lead to stress and instability within the business.

On top of all this, the business might owe money to the key person’s estate, which could be called on with little or no notice, adding to the financial strain.

Addressing these potential impacts through succession planning can ensure your business remains resilient in the face of unexpected changes. This planning helps safeguard your business’s financial stability and ensures its continuity.

Funding your business succession plan

Business life insurance is a crucial funding vehicle for your succession planning. It ensures that your business has the necessary funds to cover key financial obligations and support continuity in the event of an unexpected loss. In a nutshell, it provides the financial backbone you’ll need to implement an effective succession plan.

MAS now offers Business Life Plan to help your business overcome succession challenges.

You can cover all shareholders under a single policy and structure ownership to best suit your individual needs, and you have options to increase the level of cover when your shareholding increases without having to provide further medical evidence.

MAS Business Life Plan can fund your shareholder agreement and protect your business against the impacts of unexpected events such as the sudden loss of a key person, ensuring that your business remains resilient and in your control and continues to operate.

Key person protection: Your business’s lifeline

Imagine the impact on your business if a key person like a practice manager, highly skilled technician or key client manager passes away, falls seriously ill or becomes totally and permanently disabled. Key person cover steps in by paying a lump sum, providing a financial lifeline to your business.

This protection can help replace the revenue the key person would have generated or offset the loss of productivity from their absence. It can also cover the considerable costs associated with locating, attracting, recruiting and training a suitable replacement.

Shareholder protection: Ensuring smooth transitions

In the event of the death or total permanent disablement of a business partner, shareholder protection provides a valuable safety net. It offers a lump sum payment that allows the remaining business partners to implement their shareholder agreement.

This helps prevent potential issues such as a disabled partner continuing to receive profits without contributing to the business or new possibly unskilled owners entering the business through inheritance. These situations can cause significant stress and disruption.

Shareholder protection ensures an orderly transfer of ownership, providing the necessary funds for the remaining partners to buy out the shares. This way, the departed shareholder’s family or estate receives the pre-agreed value, while the existing partners maintain control of the business.

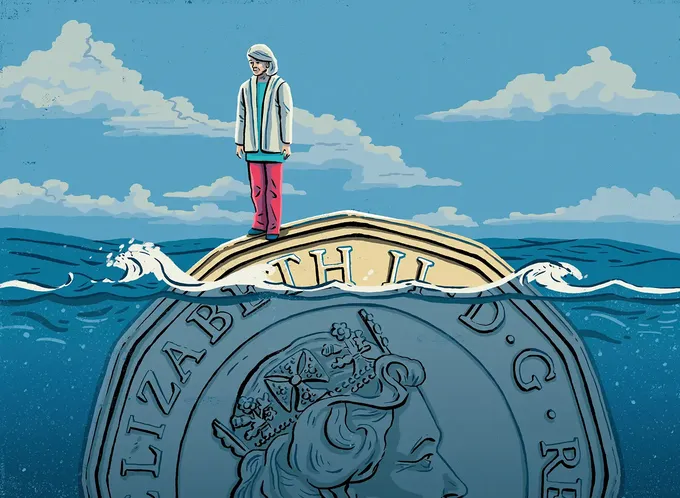

Debt protection: Shielding against financial strain

When a business borrows money, it makes sense to have some form of cover in place to repay all or most of that loan if one of the business owners unexpectedly dies or becomes totally and permanently disabled. Debt protection provides the financial support necessary to cover outstanding business loans, ensuring that the business can continue operating smoothly without the burden of unpaid debts.

This protection helps prevent personal assets such as a private residence used as security from being at risk. By having loan protection in place, a business can safeguard both its operations and the owner’s personal finances from the repercussions of unforeseen events.

Plan now to secure your business’s future

Running a small to medium-sized enterprise in New Zealand can be a hugely busy undertaking, not to mention stressful during times of economic recession. It’s completely normal to put off succession planning when you can barely find the time to handle day-to-day operations.

But unlike the Roy family in Succession who faced turmoil and uncertainty due to the lack of a clear succession plan, your business can avoid these pitfalls with proper planning. Get in touch with a MAS Adviser to talk about how we can help protect your business, now and in the future.

Know someone who might enjoy this?

Read this next

-

March 2023

Do our emotions harm or help our investing?

-

August 2023

What everyone gets wrong about emergency funds

-

November 2023

The emotional equation of retirement planning

-

April 2024

Will your money last as long as you do?

Professional life

See all-

March 2021

Made for today a century ago

-

March 2021

The great brain gain

-

March 2021

A hectic, horrific working holiday

-

March 2021

Smooth sailing for Southern Spars