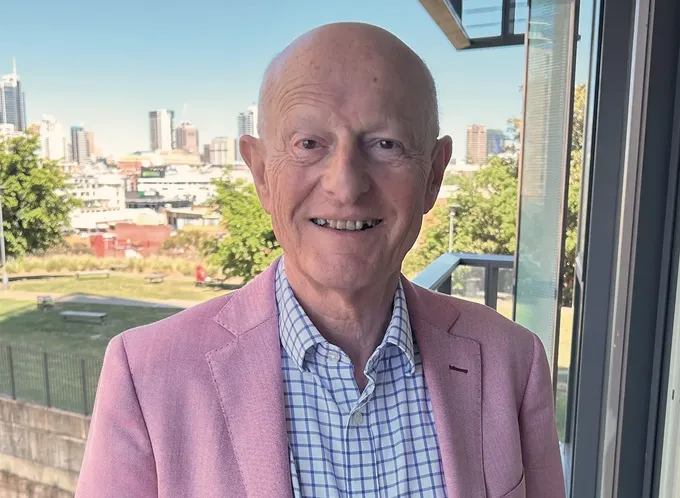

Jules Riley, Head of Growth (Investments) at MAS, shares his expert tips on how to ensure your finances stay in top shape after you retire.

Congratulations, you’ve retired. A gold watch and a new investment paradigm await you. Unfortunately, this new investment environment is one where volatility can be less of a friend. When you were working, you could take advantage of fluctuations in investment markets by regularly investing a portion of your pay cheque, regardless of market conditions. When markets fell, this strategy enabled you to buy more assets at lower prices to help you increase your total return over time.

However, as a fully invested retiree without an income, it’s harder to take advantage of volatility. To pay the bills, you will likely need to sell assets to realise income in all market conditions. During down markets, this has the effect of depleting your assets much faster as you sell them, rather than buy them, for lower prices. Poor returns are especially dangerous in the early years of retirement when your nest egg is at its greatest and can impact your income for the rest of your life.

The other big unknown is your life expectancy. For example, do you need your money to last 20 years or 30 years? This affects both how you should invest your money and also how much you can sustainably spend. According to the New Zealand Society of Actuaries,1 a 65-year-old woman is expected to have a lifespan of 90 years with one in five living until age 95. A 65-year-old man is expected to live for 87 years with one in five living until at least 93. So if you’re happy and healthy, it can make sense to plan for a lifespan of 90 to 95 years.

How should you think about investing in retirement?

As a retiree, you will likely have a few big demands of your investments.

Firstly, you need to protect what you have. You no longer have years of working life to earn any losses back, and accumulating money is quite different to keeping it. One of the most important things you can do to preserve your wealth is to diversify. Many people do not do this well.

For example, New Zealanders have around $100 billion invested in KiwiSaver schemes,2 and $240 billion in bank deposits3 but over $1.5 trillion in residential property.4 Our relatively expensive real estate market means that the average home owning retiree will probably have the bulk of their wealth in property by default.

However, if you’re retiring with a particularly valuable property or several properties and little else in your portfolio, it can make sense to downsize or reduce your exposure to diversify into other assets like shares and bonds, including those listed in other countries. This helps protect you from specific risk where one particular risk, like an earthquake, can have an outsized impact on your total wealth.

Secondly, you will probably need liquidity or easy access to your money. A lot of unexpected things can potentially happen to you over a 30-year retirement. These can be things like health emergencies, car breakdowns or storm damage to your property. You’ll likely need access to lump sums of cash to respond to these. If much of your money is tied up in term deposits, you may not be able to access your money quickly or doing so may incur a penalty. If the bulk of your wealth is invested in rental properties, you cannot ‘sell the front room’ to pay for an operation, and putting the property on the market can take time.

Thirdly, you’ll likely want to align the volatility of your investments with the volatility you’re willing to accept for your spending. If you have fixed living expenses and cannot stomach a 5% drop in your retirement income, it may not make sense for you to invest all your money in investments that generate annual returns of between -10% and +20%.

However, this doesn’t mean you should go completely into cash either. You might be retired for 30 or so years, so it’s important to strike a balance between managing volatility and growing your money to both preserve your capital and ensure it lasts the distance. This calls for some mix of growth assets (e.g. shares and property), which tend to have higher expected returns over time but more volatility, and income assets (e.g. cash and bonds), which typically have lower expected returns over time but more stability.

Investing in managed funds has several advantages in retirement

Investing your retirement savings into managed funds is a straightforward way to diversify your savings, retain access to your money and manage volatility. For example, all MAS schemes (including our new MAS Investment Funds) invest in over 1,000 different assets across multiple industries in more than 40 countries.

These funds offer easy access to your savings in retirement, enabling you to draw down lump sums or implement regular income withdrawals. You can also choose from seven different funds to help you align your investments to your risk tolerance. While the ‘right’ mix of growth and income assets will be personal to you, retirement planners often suggest funds with higher allocations to income assets, such as conservative, moderate or balanced funds.

How should you think about spending in retirement?

A popular rule of thumb for retirement spending is the fixed date rule. It recommends spending the current value of your savings divided by the number of years left to a target date. For example, if you were 70 years old, with $1,000,000 and had chosen a target date of age 90, you would divide $1,000,000 by 20 years and spend $50,000 in year 1. If markets fell over the year and your balance at the start of year 2 was $920,000, you would divide this amount by 19 (the number of years remaining until your target date) and your income for year 2 would be $48,421.

This approach gives you certainty that your savings will last until the date you have chosen. However, your income will vary along the way, your savings will run out at your target date and annual calculations are required. That said, this can be a helpful strategy for retirees with shorter-than-average life expectancies who want to spend all their savings, or those who can cover most of their fixed living expenses from other means like New Zealand Superannuation.

Many retirees don’t like the income volatility inherent in the fixed date rule, which leads us to a different, more stable drawdown strategy called the 4% rule. It recommends spending 4% of the amount you retire with each year and increasing that amount annually with inflation. For example, if you retired with $1,000,000 and inflation was 2% p.a., you would spend $40,000 in year 1, $40,800 in year 2 and so on. An attractive feature of this strategy is that it delivers you a steady pay cheque equivalent throughout retirement. It also has low cash flow volatility, and your income keeps up with inflation.

While the date at which your savings run out is unknown, international research from Morningstar5 suggests that retirees who invest in a moderate fund and employ the 4% rule should expect a 90% probability that their income will last for 30 years. If you think a 90% probability is not high enough, it’s possible to improve your odds by adding some additional parameters to reduce your withdrawal rate during down markets and increase your withdrawal rate when markets are especially strong. Aligning your spending to market performance in this way helps you optimise your spending so you don’t run out of money too early but also don’t pass away with too much in the bank either.

While the 4% rule is a helpful rule of thumb, in reality, most retirees don’t tend to spend the same amount every year throughout their retirement. Instead, their spending changes over time as people take advantage of their higher energy levels in early retirement to travel and socialise.

But as people age, they typically slow down, and this often leads to less spending. This picture is supported by research6 that suggests retiree spending tends to decline in real terms (i.e. inflation-adjusted) over the course of retirement at a rate of around 1% per year. This translates to a nearly 26% fall in real retiree spending by around age 84.7 Spending then begins to rise again at this point due to higher medical expenditures but does not necessarily exceed initial retirement levels until retirees reach their mid-90s.

The Morningstar researchers adjusted the 4% rule to incorporate this real-world retiree spending data and discovered retirees could start off with a higher initial withdrawal rate of around 5% if they adjusted their spending by 1% less than the annual inflation rate.

We’re with you on your journey through retirement

It’s true that retirement comes with some added complexities. How to invest, sustainably spend and manage volatility are all difficult challenges. While these challenges can seem overwhelming, they can be overcome. Retirement is a new adventure and an exciting phase of life. That should be your focus, and we can help you achieve that.

Our MAS Advisers can meet with you at your convenience and help you navigate this new investment paradigm with confidence. Reach out for a coffee and a confidential conversation today. For further information on MAS Investment Funds, please visit mas.co.nz/investments/investment-funds

Medical Funds Management Limited is the issuer of the MAS KiwiSaver Scheme, the MAS Retirement Savings Scheme and the MAS Investment Funds. A PDS for each Scheme is available at mas.co.nz

- NZ Society of Actuaries: Drawdown Rules of Thumb: Update 2023

- RNZ: Improving economic outlook drives up KiwiSaver value over breaks $100 billion

- Reserve Bank of NZ: Annual Growth in Household Deposits held by Banks

- CoreLogic: Is this the beginning of the end for the NZ house price downturn?

- Morningstar: The State of Retirement Income: 2023

- David Blanchett: Exploring the Retirement Consumption Puzzle

- Wade Pfau: What is the ‘Retirement Spending Smile’?

This article is of a general nature only and is not intended to constitute financial or legal advice. MAS only provides advice on products offered by its subsidiary companies. Advice is provided by MAS or its nominated representatives, who are all MAS employees. Our financial advice disclosure statement is available by visiting mas.co.nz or calling 0800 800 627.

© Medical Assurance Society New Zealand Limited 2024.

Know someone who might enjoy this?

Read this next

-

March 2023

Do our emotions harm or help our investing?

-

August 2023

What everyone gets wrong about emergency funds

-

November 2023

The emotional equation of retirement planning

Money

See all-

March 2021

Reimagining the Kiwi homeownership dream

-

March 2022

Taking an active approach to investing

-

July 2022

The Curve: Raising financial literacy