Founded on co-operative principles a century ago, MAS has supported its Members through some tough times. Established in the wake of a World War and a global pandemic, our history has been book-ended by devastating natural disasters – the Napier earthquake of 1931 and the Canterbury earthquakes of 2010 and 2011.

By MAS CEO Martin Stokes

So what prompted a group of Napier’s doctors to establish an insurance company in the first place; and what does the future hold for MAS?

As we go to press in March 2021, it’s almost 100 years to the day since four doctors met in the drawing room of a Napier villa and resolved to start an insurance company.

It’s unclear exactly what the group’s original aims were, although there’s some evidence they were motivated by the high costs of running medical practices at the time. Initially, their concern seems to have been to purchase medical supplies at more affordable rates, although eventually this focus shifted to providing insurance for medical professionals.

What’s remarkable, is that a group of busy doctors – with plenty of professional obligations to keep them occupied – found the time to set up the Medical Assurance Society.

When you think back to what was happening in New Zealand in the 1920s, though, their willingness to take on this extra work and responsibility was very much of its time.

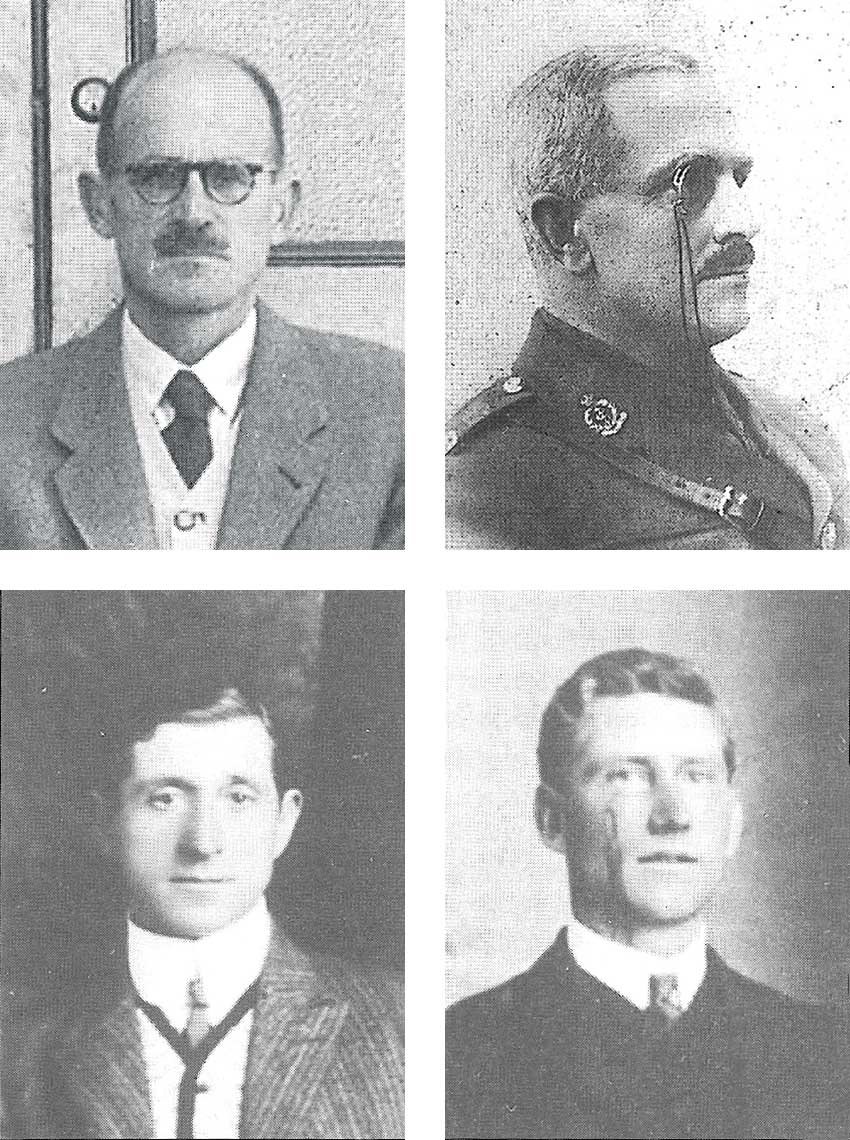

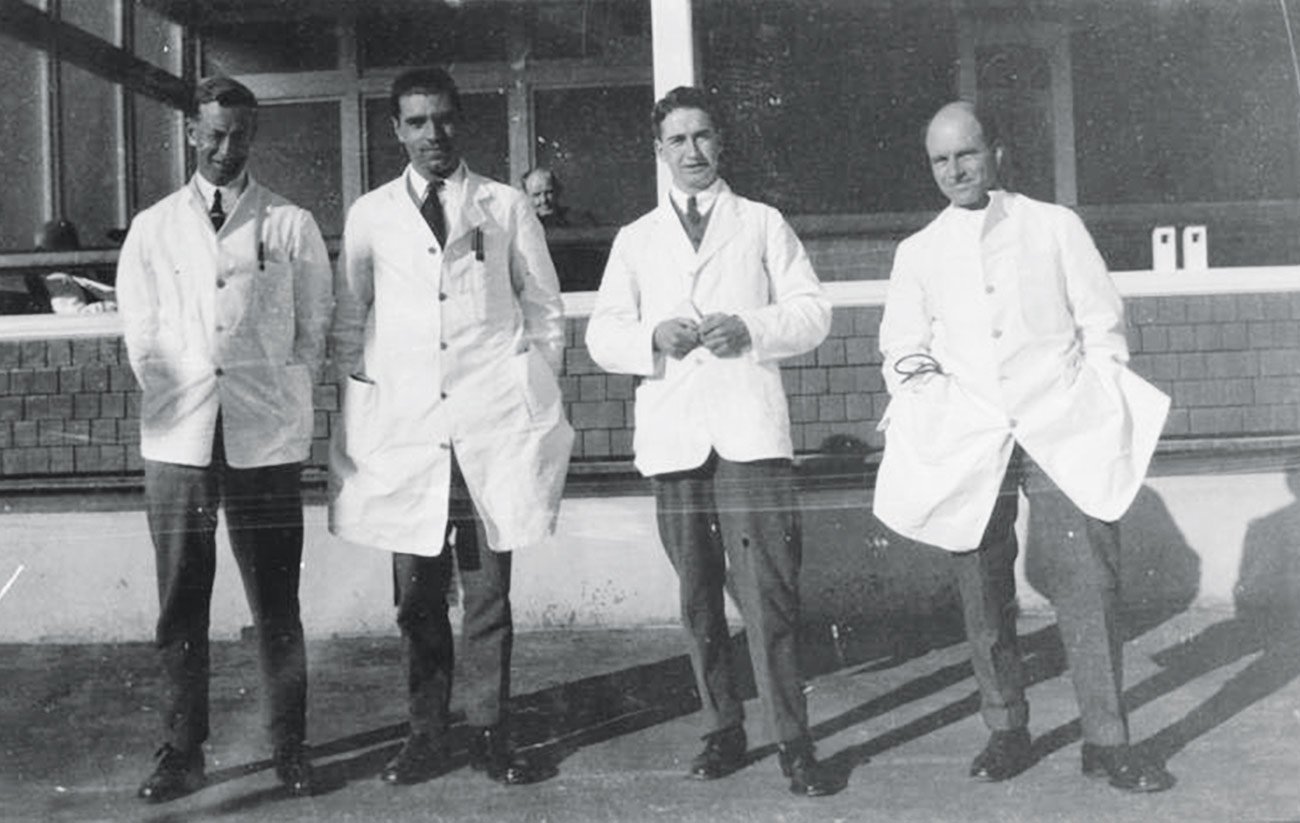

Above / (clockwise from top left) MAS founders Dr Frank Newenham Harvey, MAS Chairman 1921–1928; Dr Henry Ferdinand Bernau; Dr John Patrick Daunt Leahy and Dr John James Edgar

(clockwise from top left) MAS founders Dr Frank Newenham Harvey, MAS Chairman 1921–1928; Dr Henry Ferdinand Bernau; Dr John Patrick Daunt Leahy and Dr John James Edgar

The Harvey residence on Tennyson St, Napier, where much of the planning of the Society took place

Top / The Harvey residence on Tennyson St, Napier, where much of the planning of the Society took place

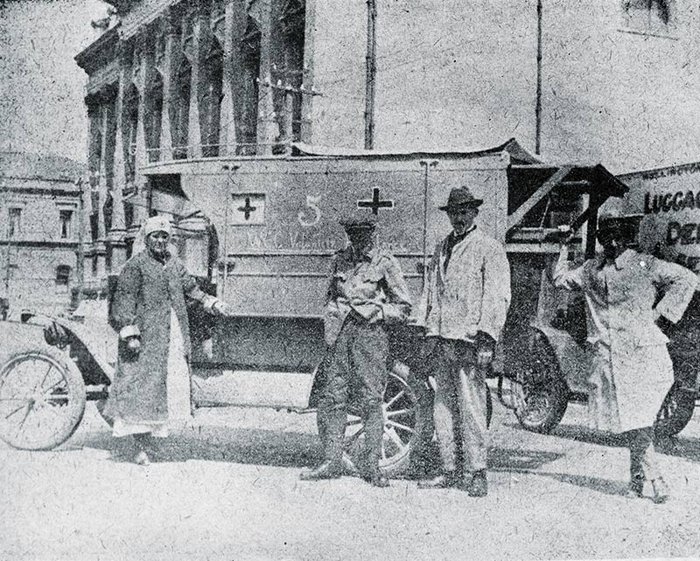

Bottom / Nurse Hickey, alongside an ambulance in Wellington during the influenza epidemic (Credit: Alexander Turnbull Library)

Nurse Hickey, alongside an ambulance in Wellington during the influenza epidemic (Credit: Alexander Turnbull Library)

New Zealand’s most harrowing years

The driving force behind the formation of MAS was 33-year-old Irish-born Dr Frank Harvey. In 1921, he and his generation of doctors had just witnessed seven of the most harrowing years in New Zealand’s history – World War One immediately followed by the Spanish flu pandemic.

Dr Harvey, a radiologist, served as a medic at Gallipoli and the Somme. Few would have had such a close and unrelenting view of the horrors of a war that killed 18,000 New Zealanders. The total list of New Zealand’s killed and wounded was well over 100,000 – around a quarter of the Kiwi men eligible for military service (aged between 18 and 45).

If that wasn’t enough, on his return home, Dr Harvey and his contemporaries found themselves on the frontline of the 1918 Spanish influenza pandemic. From mid-October to mid-December 1918, at least 49% of the population was infected with the flu.

In some areas, more than 80% of households were affected. In just two months, around 9,000 people had died.

New Zealand’s population in 1921 was barely 1 million, and the war and pandemic had killed 27,000 people. Adjusted for population, it would be like losing 125,000 today.

To make matters worse, 1921 saw the onset of a sharp post-war recession. Inflation was rampant, with the cost of imported goods rising by 67% between 1917 and 1920, while export receipts slumped by up to 30%.

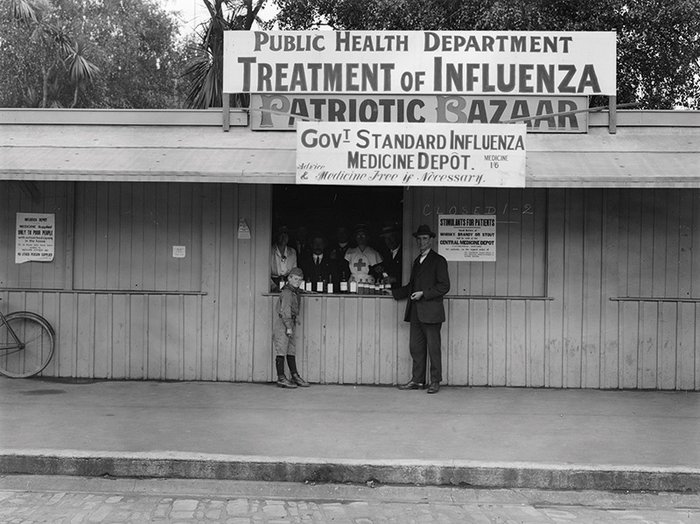

An influenza medicine depot in Christchurch, December 1918 (Credit: Alexander Turnbull Library)

Top / An influenza medicine depot in Christchurch, December 1918 (Credit: Alexander Turnbull Library)

Bottom / New Zealand soldiers on a ship in 1919 (Credit: Photographer Herbert Green. Te Papa)

New Zealand soldiers on a ship in 1919 (Credit: Photographer Herbert Green. Te Papa)

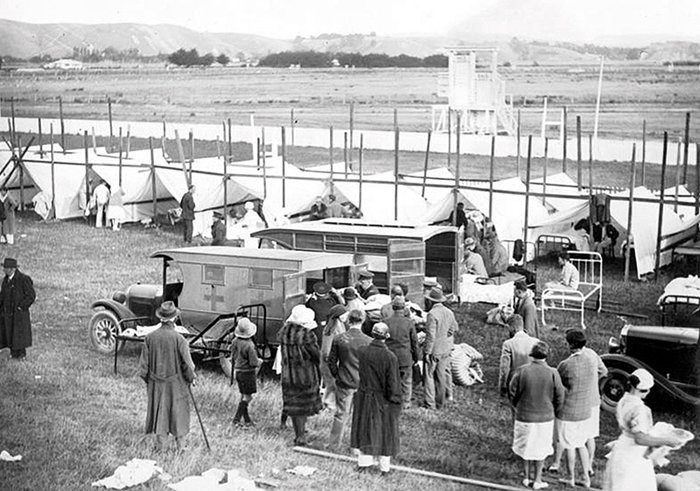

A field hospital set up to treat the wounded after the 1931 Napier earthquake

Top / A field hospital set up to treat the wounded after the 1931 Napier earthquake

Bottom / Road affected by the earthquake in Hawke’s Bay, February 1931 (Credit: Alexander Turnbull Library)

Road affected by the earthquake in Hawke’s Bay, February 1931 (Credit: Alexander Turnbull Library)

An era of optimism

Yet despite these tragedies, 1921 was also an era of optimism. New Zealand had emerged from the war with a new sense of nationhood and a growing determination to forge a better society than what had gone before.

Our health professionals were particularly motivated to remake systems and create new institutions. New Zealand was a world leader in infant care, and the 1920 Health Act was regarded globally as innovative and far sighted.

House surgeons at Napier Hospital in 1921

The 1920s also saw the beginning of a significant economic transformation as our economy began to mechanise faster than ever before.

Among the most profound changes was the replacement of horses with cars and trucks – a shift of particular significance for doctors. In many provincial towns, it was the local doctor who had the first car since they had both the means to purchase one and the need to drive to house calls at all hours of the day and night.

However, premiums for motor vehicle insurance in provincial areas were astronomical and excluded cover for women if they were driving. Unsurprisingly, then, one of the first ventures of the fledgling Society was affordable motor vehicle cover for doctors. The other main offering was income protection since it was difficult in the unsettled economy of 1921 to find an insurer willing to offer reasonably priced personal injury and illness cover to the medical profession.

From these immediate practical needs emerged a company well placed to not only survive but thrive, particularly in the aftermath of World War Two. Strangely enough, the co-operative model Dr Harvey and his colleagues had adopted in the 1920s proved one of the mutual’s strongest features, even as co-operatives were in decline around the world.

As a mutual, MAS’s customers become Members and shareholders in the company.

The primary purpose of a mutual is not to make a profit for external shareholders, as with a limited liability company, but to serve the interests of its members.

It was hardly a new idea in 1921, but it’s one whose emphasis on shared benefit and sense of mutual interest has recaptured the attention of the business world in the twenty-first century.

Increasing social inequality in developed societies and the climate crisis have seen leaders of some of the world’s largest corporations reject the old business doctrine of “profit before all else”. There’s general acceptance from business leaders all over the world that the pursuit of short-term profits in the supposed interests of shareholders destroys social cohesion and our planet. Larry Fink – CEO of Black Rock Partners, which controls NZ$9 trillion worth of investments – has demanded that companies declare a purpose beyond profit. The free-market American Business Roundtable has publicly stated that corporations should serve multiple stakeholders – their customers and their societies as well as their shareholders.

The proof is always in the pudding when these sorts of claims are made, and there are plenty of concerns about companies trying to launder their reputations and business dealings by expressing concern for the environment or the wellbeing of society. But it’s clear that attitudes are changing, and it would be a particularly tone-deaf corporate leader to declare unapologetically in 2021 that “greed is good” as they might have done in the 1980s.

At MAS, this supposedly revolutionary thinking can feel like history repeating. As a mutual, MAS has never had to choose between what’s good for our customers and what’s good for our shareholders – for us, they are one and the same.

With growth comes opportunity

MAS started out as a way of helping medical professionals take care of themselves and families, but as we’ve grown, we’ve evolved.

MAS has never felt the need to become a corporate giant through acquisition, and prudent financial management has meant we’re in a strong position to weather the uncertain economic times ahead as the world emerges from the COVID-19 pandemic.

Instead of shareholder dividends, we’ve concentrated on delivering the best service we can to our Members, and we’re proud to have received the Consumer NZ People’s Choice Award for house, car, contents and life insurance for the past five years in a row. We’re humbled by that recognition because it’s not just another industry award – it’s an expression of our standing with our Members and the wider public.

As we’ve grown, we’ve become large enough to look beyond our immediate membership to see how we might be able to also support the communities within which our Members live and work. Over the past three years, in particular, we’ve worked hard to define our social purpose and place it at the centre of everything we do.

The establishment of the MAS Foundation is one expression of this focus, and it is already making a meaningful contribution to the health and wellbeing of New Zealand communities, particularly those that have traditionally been underserved by our health system.

The COVID-19 pandemic also helped catalyse our sense of how we can make a difference to our Members in their day-to-day lives. We put together the MAS Relief Package to ensure Members who struggled financially through lockdowns were supported and didn’t have to worry about how they would maintain their insurance when times were tough.

We’ve begun partnering with more organisations who share our values and are working to make a difference to the health of New Zealand – from the Sustainable Business Network to Wāhine Connect to Te ORA – and we will continue to explore new opportunities to help other organisations achieve common goals.

I’m proud that MAS is at the forefront of a shift in corporate mindset towards doing more for our communities – but I’m not surprised.

MAS has never been an ordinary company. From the very start, we have enjoyed an unusually close relationship with our Members who, quite rightly, feel a sense of ownership of the mutual. In many cases, we form decades-long relationships with our Members, and we serve multiple generations of the same family.

We don’t take these relationships lightly or treat them as inevitable. We don’t think of our Members as ‘customers’, since this implies nothing more than a casual passing acquaintance. Instead, we feel a sense of responsibility not just to do the right thing by our current Members but to honour the principles of our founders and live up to the expectations of generations of Members.

In February, we marked the tenth anniversary of the Canterbury earthquakes – a timely reminder of the continued importance of community spirit and mutual support. As we enter our second century, the spirit of co-operative service with which our mutual was established has never been stronger as we evolve into a company even better suited to serving our Members and our community.

Know someone who might enjoy this?

Professional life

See all-

March 2021

The great brain gain

-

March 2021

Smooth sailing for Southern Spars

-

March 2021

A hectic, horrific working holiday

-

March 2021

What's on