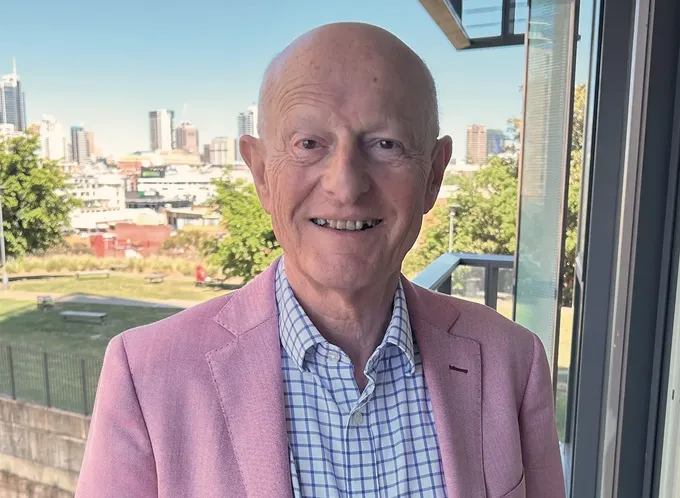

If most of your net worth is tied up in your house, then Jules Riley, MAS Head of Growth (Investments), wants you to consider 2 very important questions: Is your wealth over-concentrated in residential property? And if so, what should you do about it?

Kiwis love investing in property. You can touch the bricks, feel the mortar and it’s considered ‘as safe as houses’. It’s also performed well as an investment. Over the last 30 years, residential property has delivered annual returns of around 7% and valuations have risen sevenfold.

While this rate of growth was slightly lower than the share market over this time, it was delivered with less volatility along the way. You can also fund part of a property investment with debt, further boosting your return on equity.

The house view

New Zealand’s housing market is now valued at around $1.6 trillion. This is close to 4x the size of the nation’s annual GDP and around 10x the value of all the companies listed on the New Zealand stock exchange. Strong house price growth over the past 30 or so years has boosted the house price to income ratio from around 3x to around 7x. This places New Zealand house prices among the highest in the world relative to incomes. If the growth of the past 3 decades were to continue uninterrupted, it would mean a house price to income ratio of over 15x in 30 years’ time.

That seems unlikely not only because banks will need to comply with the new Reserve Bank debt-to-income caps of 6 – 7x income but because the macro environment has also changed. Two of the big drivers of house prices over time have been the substantial decline in mortgage rates and the lack of housing supply.

Mortgage rates peaked at above 20% in 1987 before falling to around 2% in 2020. This long decline made it steadily easier for people to borrow and helped push up the price of housing over time. But once the OCR hit 0.25% as it did in 2020, it’s hard to go much lower. Now the OCR is 5.5%, 1 year mortgage rates are around 7% and it’s taking time to get inflation back down to target. Higher mortgage rates are proving to be a handbrake on the housing market, and property prices are still down around 10% from their peak in 2021.

While housing supply is still a big issue, major steps have been taken by councils in recent years to increase supply by upzoning land density.

Research published last year by the University of Auckland found that the Auckland Unitary Plan, which upzoned around three-quarters of residential land, has helped reduce rent inflation by 22–35% since 2016. Other councils have followed, with sweeping changes to zoning rules recently approved for Wellington, which will enable the construction of tens of thousands of new townhouses and apartments.

These structural changes do not necessarily infer that house prices will fall further or stop rising. Inflation, real improvements to housing stock and population growth are all expected to support prices going forward. Demand will also be sustained by the many non-monetary benefits of housing such as the ability to live in a safe environment close to work, schools, friends and family. However, significant changes to the macro environment do serve to highlight the wisdom of diversification. Some of the previous tailwinds for housing have now abated, and it can make sense to hedge your bets.

One house on one street

Rapid house price growth over the past 30 years means that New Zealanders now have almost 60% of their wealth concentrated in owner-occupied and rental housing. Given that only 64% of the population own homes, by nature, the average homeowner will have even more exposure to property.

One house on one street in one city in one country is a very concentrated and illiquid portfolio. While concentrating your risk can be one of the fastest ways to grow your wealth, it can also be one of the fastest ways to lose it.

Diversification is perhaps the most effective way to protect your money over time. Spreading your risk across different assets, industries, countries and currencies shields you from specific risks.

For example, where one particular risk like a cyclone or interest rate hike can have an outsized impact on your total wealth.

While the high cost of housing means that a large exposure to property is probably somewhat inevitable, you do have a choice with what you do with the remainder of your wealth. A good option for this can be a managed fund. MAS Investment Funds, for example, can give you exposure to over 2,000 different assets across various industries in more than 40 countries. The funds also provide you with easy access to your money. While you can’t sell the front room of your rental property to free up cash in an emergency, MAS Investment Funds let you withdraw money at your convenience.

Risk is what you can’t see

Many of the biggest risks in life are surprises. No one predicted the 9/11 terrorist attacks, the Global Financial Crisis or the Covid-19 pandemic. Nor could they. Yet these surprises shaped investment markets and the world.

All you can do is prepare. Some investments can perform strongly for a long time, but not forever. While many remember the stock market crash of 1987, we forget the New Zealand housing market downturn of the 1970s. Such was the scale of the decline, it took 20 years for real (inflation-adjusted) house prices to recover. Other countries have faced similar events. Real house prices in Japan are well below what they were in the 1990s, while real house prices in both Italy and Ireland are still below their 2008 peaks. Volatility and periods of weakness are inevitable and can continue for years.

Diversification remains one of the most effective ways to protect your wealth, enabling you to offset losses in one asset with gains in another. This is an area where MAS can help. Your personal MAS Adviser can work with you to understand your level of risk concentration and help you diversify your wealth accordingly. Please reach out for a coffee and a confidential conversation today by contacting us at investments@mas.co.nz or calling 0800 800 627.

This article is of a general nature only and is not intended to constitute financial or legal advice. © Medical Assurance Society New Zealand Limited 2024. MAS is a licensed financial advice provider. Our financial advice disclosure statement is available by visiting mas.co.nz Medical Funds Management Limited is the issuer and manager of MAS Investment Funds. A PDS is available on our website.

Read this next

-

November 2023

The emotional equation of retirement planning

-

April 2024

Will your money last as long as you do?

-

August 2024

Lawyer in the house

-

August 2024

Succession challenges

Money

See all-

March 2021

Reimagining the Kiwi homeownership dream

-

March 2022

Taking an active approach to investing

-

July 2022

The Curve: Raising financial literacy